This past week has been tough for Cryptoland. Almost the entire market was red again. In particular, a number of technical indicators gave important signals. Here are the top three things we learned last week Bitcoin (BTC)†

1: Bitcoin drops through moving averages

Yes we know: Moving averages Very simple and doesn’t say much about what the future will bring. However it is very important. Like regular trend lines, they give a clear picture of whether the trend will end or not. If we look at the 100-week moving average for Bitcoin, we see that the price of BTC in dollars has clearly fallen through the moving average. Bitcoin is currently doing better against the Euro, although BTC/EUR has passed its support as well. However, it only happened after one weekly candle. At the time of writing, the price of Bitcoin in Euro is €29,715 Petavavo†

2: Candles and volume do not indicate a bottom

Also from the individual candelabra We can deduce what is necessary. For example, the weekly candles have all been red since the week of March 28th, and since then the shorter period candles have also shown that Bitcoin is in a downtrend. Sure enough, the weekly candles are gradually declining. They are not waterfall drops that indicate exhaustion, but candles that sometimes cannot rise above resistance to erupt.

The volume also indicates that the bottom has not yet appeared. No size approx. This does not mean that the downtrend is coming to an end. That is, if the price is not paid by the big buyers. definitely in Cryptocurrency Bottoms often have a massive peak in size. As long as the volume remains low, it is clear that the trend will continue to decline.

3: BTC sentiment is very negative, on support

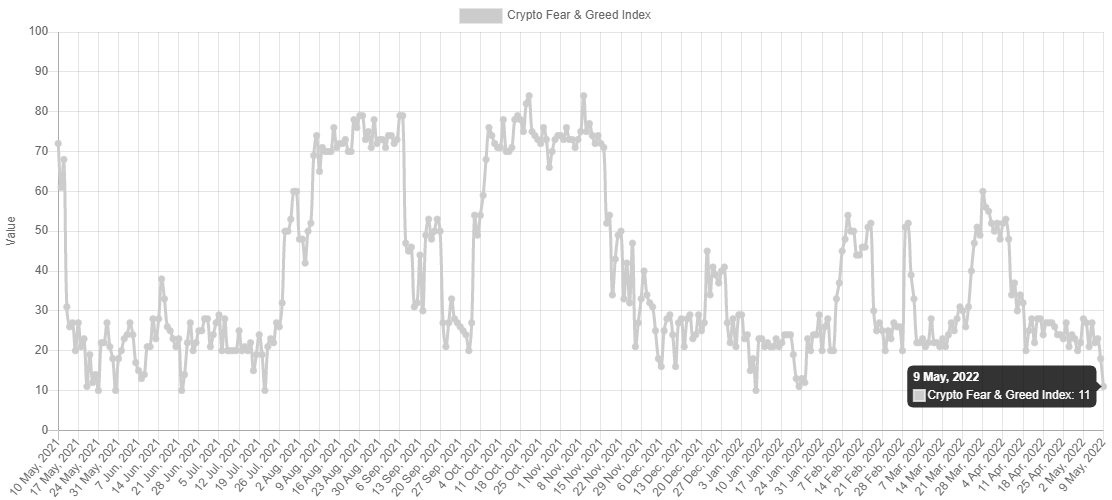

However, sentiment is so negative that we have to ask ourselves if the bottom isn’t too close. as we are Already described this morning The Fear and Greed Index has reached an all-time low. This usually indicates that at least a significant bottom is in progress. Everyone sits on one side of the “boat”. People will move to the other side of the boat, causing prices to go up.

At the same time, a strong support line can also be negative. The last support line is only 20% from the current price. If a break occurs, the next support will be above 2017 – that is, 11,000 euros. This is a hard landing.

Wonderful! We all know that having a fear and greed index in a state of intense fear does not necessarily mean a bottom. But getting a score as low as 11 is very rare.

The arrows on the chart show previous scores of 11 or less.

Live graph: https://t.co/Jr5151zN7I pic.twitter.com/T6he5i8OeA

– Philip Swift (@PositiveCrypto) May 9, 2022

“Total coffee specialist. Hardcore reader. Incurable music scholar. Web guru. Freelance troublemaker. Problem solver. Travel trailblazer.”

More Stories

Are there enough charging stations and can the electricity grid handle them? The five most frequently asked questions about electric driving

House of Luna and Sven from Haaltert have been uninhabitable for several months due to a failed roof renovation: “The contractor has not been heard from again, we are mentally exhausted”

European stock markets open higher beursduivel.be