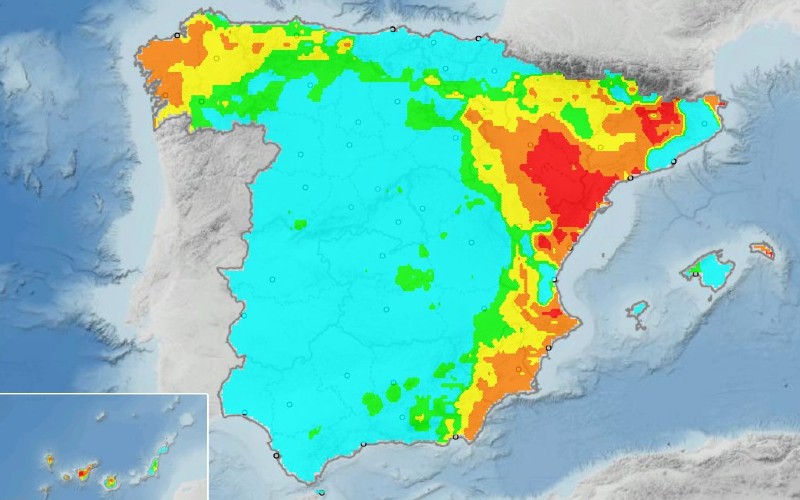

The macroeconomic environment has been less than ideal for many financial markets this year. Moreover bitcoin The price of (BTC) has fallen by more than 60% since the beginning of the year. Despite this, the trading volume has been reasonable since July this year stationary stayed. In addition, it appears that a large number of investors continue to hold onto their bitcoin despite the bear market. What exactly does all this mean?

Will bitcoins survive?

Outside Data from analytics company Glassnode It shows that the number of long-term bitcoin holders is increasing and therefore they generally do not sell their coins. This is clearly one of the reasons why the Bitcoin price has been relatively stable over the past few months.

from further dates Of the Glassnode, 60% of the bitcoin supply in circulation has been inactive for more than a year. Although this is a positive sign and can lead to price stability, it is not a guarantee. In 2018, a period of similar stability was followed by a bloody month. At the end of 2018, the Bitcoin price fell by no less than 50% from November to December.

Bitcoin miners are in serious trouble

However, there is a lot of selling pressure at the moment Bitcoin miners. The hash rate is historically high, but the price is low. In addition, energy prices and equipment costs are rising which leads to higher debts. In July alone, Bitcoin miners combined $4 billion for debt. This is why many bitcoin miners have had to sell their mined bitcoins and their bitcoin reserves recently.

So the miners are facing a serious problem. asks a leading miner bankruptcy The stock prices of mining companies are close to evaporated. The coming months will be crucial for many miners. A quick recovery will come in time for these companies that can barely keep their heads above water. However, they are very dependent on the actions of the US Federal Reserve, which continues to raise interest rates in its fight against inflation.

The world is suffering from decades of hyperinflation, there is an energy crisis in Europe, there are global supply chain problems, and bitcoin miners are barely keeping their heads above water. Despite it all, long-term holders of bitcoin still seem confident and unwilling to sell. In the coming months, we’ll see if a scenario like late 2018 repeats itself or if the owners lose out. Diamond hands will remain closed.

“Total coffee specialist. Hardcore reader. Incurable music scholar. Web guru. Freelance troublemaker. Problem solver. Travel trailblazer.”

More Stories

Samsung switches to a six-day work week

Are there enough charging stations and can the electricity grid handle them? The five most frequently asked questions about electric driving

House of Luna and Sven from Haaltert have been uninhabitable for several months due to a failed roof renovation: “The contractor has not been heard from again, we are mentally exhausted”