Listen to the audio version of this article below

- The war in Ukraine will take surprising turns almost every day, which will have a huge impact on the financial markets.

- Currently, investors view the United States as a safe haven, given the growing differences between stock markets in Europe and the United States.

- Stock market experts Michael Nabaro and Kogan Erem have highlighted the current developments in the financial markets.

- read more: Central banks are being pushed into a difficult equilibrium process: what to do as an investor?

Analysis – We woke up on Friday Fire at Europe’s largest nuclear power plant, After a fight broke out between Russian and Ukrainian soldiers near the plant. Fortunately, the fire was reported to have been extinguished soon. However, now the Russians are the bosses there!

The unexpected twists and turns that occur every day show just how chaotic the Ukrainian war is. Suspicion and turmoil are reflected in the financial markets with large changes within different regions and property classes. It needs more detailed study.

We will soon create a trilogy of text about this Premium contributions For Business Insider, we analyze changes in commodity, interest rate and equity markets, respectively. This is certainly important for the position of investment portfolios. Don’t miss it!

The differences between the United States and Europe are growing

Regarding the current situation. European stock markets have been hit hard by the question of whether the new bottom will be made soon or whether the downward trend will continue.

In the United States, stock markets are in decline. This is not surprising since European trade has closer ties with Russia and Ukraine than with the United States. In Europe, there are many more companies writing off Russian assets, in particular Financial institutions are currently in a falling corner.

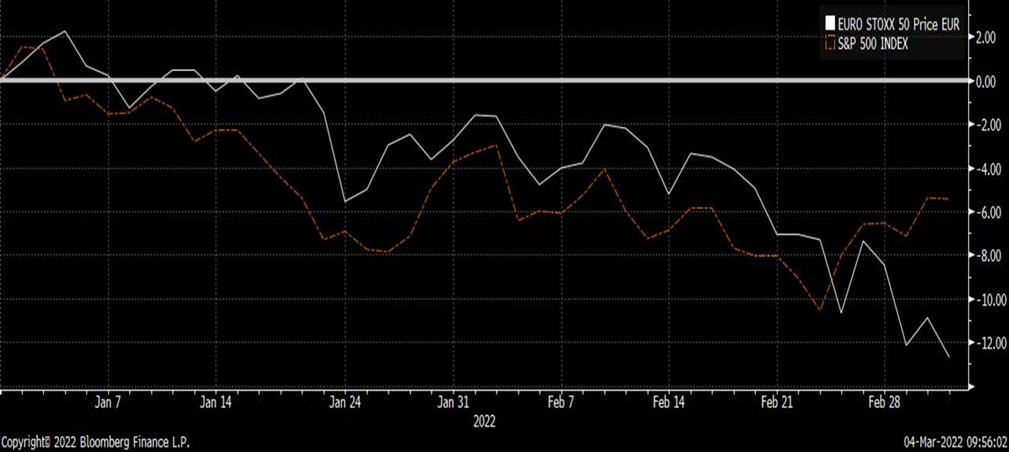

The chart below shows a comparison between the broader US S&P 500 Index (orange line) and the Eurostoxx 50 index (white line). A one percent comparison was made between the two indices in the euro.

Although both indices have fallen, the relative difference in earnings this year in favor of the S&P 500 index has already increased by more than 7 percent. That is very significant.

In addition to the huge economic impact of the conflict in Ukraine on Europe, we also see the different policies of the central banks.

In view of the high inflation, the US Federal Reserve Tighten monetary policy by raising key interest rates. This may be a little slower than expected as the Federal Reserve is still trying to maintain some balance between supporting economic growth and keeping inflation in check.

The European Central Bank will prioritize mitigating the coming economic downturn rather than combating inflation. In other words: be very careful in changing the cheap monetary policy.

This creates differences in the expectations of economic growth and interest rate policy in Europe and the United States, which is also reflected in the foreign exchange market. Is there Euro The euro weakened to $ 1.09 against the dollar, the lowest level since April 2020.

It is related to the transfer of capital from Europe to the United States, the expectation of higher interest rates in the United States and the perception that US stocks are less vulnerable to the geopolitical and economic consequences of the war in Ukraine.

The central bank cannot ignore the high inflation risk in the United States

Looking at the developments in the United States in a little more detail, The Employment statistics This week, the US labor market is tight, but not yet with wage increases.

High inflation in the United States, mainly due to supply factors in the commodity markets and supply chains, reduces real wages. In other words, the purchasing power of Americans is under pressure. It keeps fears of stagnation alive, or a combination of weak economic growth and high inflation.

The US Federal Reserve needs to find a balance. As we wrote earlier this week. A lot Analysts expect Considering the risk of inflation, the Federal Reserve has maintained a four- or five-point rise this year, pushing the key rate to 2 percent. The central bank is also expected to cut its debt sharply in the fall on the central bank’s balance sheet.

In short: The pressure to tighten monetary policy in the United States is high because exploding inflation does not make anyone happy. Just ask Russians Or the Turks.

S&P 500: Secure port, but for how long?

As mentioned above, the United States is seen as a relatively safe haven by investors and geopolitical tensions in Europe are seen as a local issue. Still.

In this regard, it is important to keep an eye on the broader S&P 500 index chart. Last week we overshadowed the broader US stock index price growth with blue. The S&P 500 shows that it is virtually unchanged on a weekly basis.

Another volume this week, but in red. Again, America has a smaller curriculum, which is quieter than it was a week ago.

Now that the S&P 500 appears to be operating in a controlled manner, Europe may breathe a sigh of relief next week. With a warning, of course, about the uncertainty about the further escalation of the war in Ukraine.

An important detail in the field of geopolitics is in China this weekend National People’s Congress meeting, Discusses economic and political priorities for 2022. Can you mention Taiwan at this year’s conference?

Michael NabaroChartered Marketing Technician (CMT), Kogan Erem, CMT, Independent Investment Specialists, both with over 25 years of experience in the financial sector. With thorough knowledge and extensive experience, they serve professional and private investors based on their systematic, proactive investment method.

This column contains the authors’ comments and findings. The financial values mentioned in this letter may be part of the authors’ investments and their relationships.

This column is not advisory in any form and is considered non-personalized information about financial markets.

“Passionate analyst. Thinker. Devoted twitter evangelist. Wannabe music specialist.”

More Stories

Anti-Israel protests at American universities are becoming increasingly violent

TikTok may be banned in the US

America with basketball stars like James and Curry