Adjusting to an uncertain future

Investment managers at T. said the Russian invasion of Ukraine exacerbated these risks by raising food and energy prices and further disrupting global supply chains.

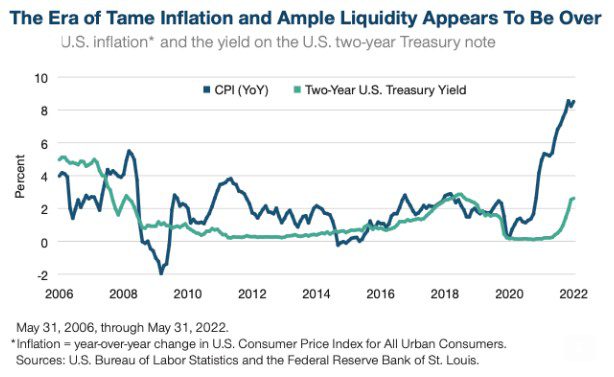

Inflationary “shock after shock” has increased pressure on the US Federal Reserve and other major central banks to tighten monetary policy while making it more difficult to contain inflation without slowing economic growth, said Sebastian Page, head of multiple global assets and chief investment officer (CIO). “The three biggest challenges for investors in the coming months are inflation, inflation and more inflation,” Page says. “It’s the transmission mechanism of all the other risks we’re dealing with.”

“The key question now is whether these risks will lead to a sharp slowdown in growth or push major economies into recession, leading to lower corporate profits as well,” warns Page. In addition to cyclical risks, investors should also note that global markets have reached a structural tipping point – the end of the era of ample liquidity, low inflation and low interest rates that followed the global financial crisis of 2008-2009.

Central bank liquidity has been essential to stabilizing economies and markets during the financial crisis and the coronavirus pandemic, notes Justin Thompson, head of international equities and chief information officer. Thompson added that the new status may also provide potential opportunities for investors with the necessary research skills and capabilities to discover them. “In volatile markets, active management can be your friend.”

Fundamentals remain essential

The sharp rise in bond yields largely caused global equity losses in the first half of the year. In the second half of the year, stock market performance will depend on corporate earnings growth expectations. After being extremely negative for most of 2021, Page notes that real yields on 10-year government bonds turned positive at the end of April. As a result, US stocks are nearing the middle of their recent historical range. As growth concerns mount, Page said, attention is shifting to the “E” side of the P/E ratio. “Everyone is wondering if the next price drop is in the making there.”

While earnings momentum weakened in many non-US markets in the first half of the year, earnings per share growth in the US remained surprisingly stable. But Page does not believe this will continue. “I think US earnings are likely to weaken in the second half of the year under the pressure of slowing economic growth,” he expects. Page says supply chain improvements can also affect profits, but perhaps not in a good way. While “moving” more products can boost sales and revenue, it can also reduce pricing power and hurt profit margins.

Industry and style transformation

In the past, once corporate profits fell, the growth investment style was preferred, which tends to be less affected by cyclical downturns. But, says Thompson, this time could be different, given the heavy weight of the tech sector in the world of growth stocks. “The pandemic has really pushed digital transformation forward, so we’ll have some very strong earnings comparisons for 2021 in the second half,” Thompson explains. “We are also seeing some late-cycle effects that are hurting technology, such as skill shortages and salary inflation.”

He added that consumer-facing technology platforms, such as streaming media, may also experience periodic slowdowns in spending. These factors suggest that the back-and-forth style we’ve seen since the pandemic recovery is skewed in favor of value. “There seems to be a shift in market leadership,” says Thompson. “As we’ve seen in the past, these cycles tend to be long.”

China offers opportunities

Thomson suggests that with the MSCI China Index down nearly 50% in late May from its peak in early 2021, Chinese stocks look attractive. However, Beijing’s “zero COVID” strategy has been a major obstacle to a rebound in growth. “China has the potential to catalyze,” Thompson notes. “But it doesn’t make sense to stimulate your hand and keep it in your purse at the same time. It’s like pressing the gas pedal and the brakes at the same time.”

Thompson said it was not yet clear how effective Chinese policymakers would be in boosting growth in the second half of the year. In addition to the coronavirus, falling property values and defaults could put stimulus efforts to the test. Thompson adds that in a world where many central banks extract liquidity to combat inflation and governments in many developed countries run large budget deficits, China at least has room to focus its policy on supporting growth.

Thomson is reluctant to forecast a switch to non-US stocks in the second half of the year, given the broad outperformance of the US market over the past decade. If the appreciation of the US dollar slows in the second half of the year and the technology sector continues to suffer, the relative performance of non-US stock markets should at least improve, he says.

“Total coffee specialist. Hardcore reader. Incurable music scholar. Web guru. Freelance troublemaker. Problem solver. Travel trailblazer.”

More Stories

Astronomers have discovered a new molecule in space. And it's very special

Will it soon be possible to freeze humans and then thaw them again?

Do you also find it difficult to eat more fruits and vegetables? A little scrolling through social media can help