Bitcoin (BTC) rose to $72,000 this week thanks to the approval of Ethereum (ETH) ETFs in the US.

However, the price then fell sharply due to strong economic data from the United States. This strong data quickly reduced confidence in rapid interest rate cuts by the Federal Reserve, the US central bank.

Some important data points are scheduled to be announced next week, which could determine the trajectory of Bitcoin’s price in the coming weeks.

Important dates for Bitcoin next week

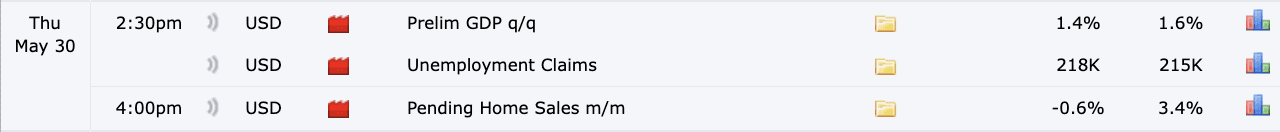

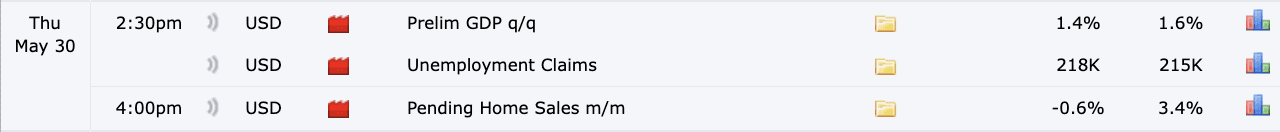

Starting Thursday, we will receive a new estimate of US economic growth for the second quarter of 2024. If that growth disappoints, it will provide a significant boost to the price of Bitcoin and the rest of the financial markets.

Why? If economic growth is lower than expected, this will ease pressure on inflation and the Fed may have to step in with faster interest rate cuts to support the economy.

The weekly number of unemployment claims will also be shown on Thursday, which provides insight into the development of the US labor market. The higher this number, the worse the news is for the economy, but this could be good for the price of Bitcoin.

This is especially good for Bitcoin if the number of claims is much higher than expectations, as this increases the likelihood that the Federal Reserve will adopt a more accommodating policy, which could be positive for Bitcoin’s value.

Focus is on Friday with the PCE price index

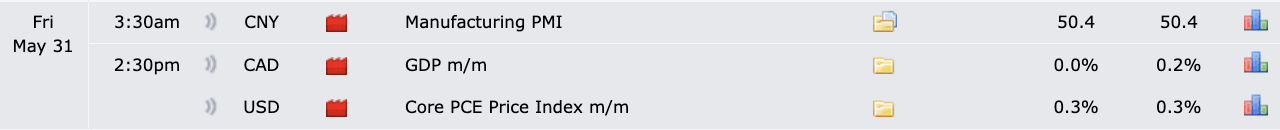

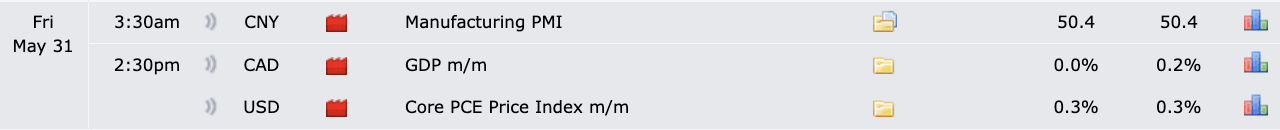

However, the real focus for next week will be Friday. We are then presented with the US central bank’s preferred measure of inflation: the personal consumption expenditures price index.

After the “positive” CPI report last week, it would be nice to see lower inflation numbers next Friday.

In theory, this could cause the price of Bitcoin to rise again. However, based on last week’s data, the chance of this happening looks slim, but in theory, this gives room for increases if (with any luck) we see lower inflation data.

Looking for more depth into crypto?

In our Discord society We discuss important macroeconomic developments and their potential impact on the price of Bitcoin every day. Here you enter a safe space where traders of all levels share knowledge.

Ask your questions to expert analysts and top traders about trading, market trends and cryptocurrency topics in a vibrant community. We also organize weekly live streams and webinars for traders who want to delve deeper into technical analysis.

Post views: 2,196

Do you want to stay one step ahead of the market? Join our vibrant Discord community With over 12,000 members! Here you can easily discuss the latest cryptocurrency trends and forecasts.

“Total coffee specialist. Hardcore reader. Incurable music scholar. Web guru. Freelance troublemaker. Problem solver. Travel trailblazer.”

More Stories

European stock markets are expected to open lower.

Bosman transfers the company to the Finns.

Belgian businessman saves Flemish stores from collapsing fashion chain Scotch & Soda