(ABM FN-Dow Jones) European stocks prepare to face a divided opener on Friday,

IG expects an opening 17 point loss for the German DAX, a 25 point increase for the French CAC 40 and an 18 point increase for the British FTSE 100.

Stock markets in Europe closed higher on Thursday.

Market analyst Michael Hewson of CMC Markets noted that European stock markets were primarily busy processing the Federal Reserve’s interest rate decision on Thursday. The Fed clarified on Wednesday evening that it is likely to raise interest rates in March. According to Howson, markets are now anticipating five rate hikes in 2022.

Hewson said Powell did not take the opportunity to rule out the possibility that the Fed would raise rates with every decision this year or by 505 basis points each time if necessary.

Hewson noted that markets were able to recover during afternoon trading after strong growth data from the US.

On the macroeconomic front, calm prevailed in Europe on Thursday. GfK reported that consumer confidence in Germany improved slightly in February. The negative confidence number of 6.9 was much better than the negative number of 8.0 that had been expected.

company news

Deutsche Bank generated more revenue and profit than expected in the fourth quarter, and was surprised to announce that nearly all of the costs of the reorganization were booked. The stock rose about 4.5 percent.

SAP had higher sales in the fourth quarter of last year, but its operating profit and margins came under pressure, which is in line with the preliminary numbers. The stock lost 6 percent.

At EasyJet, the loss nearly halved in the first quarter of the broken fiscal year, but the coronavirus omikron variant is affecting bookings in the short term. The share increased slightly.

Paris-based STMicroelectronics’ quarterly figures were rewarded with a 2 percent increase in its stake. The chip maker wants to invest billions in expanding its capacity.

In Paris, Sanofi’s share price gain of more than 3 percent was a staggering, along with a loss of more than 2.5 percent for Dassault System share.

In Frankfurt, RWE stock posted a price gain of more than 5 percent and Delivery Hero stock fell more than 3 percent. In Amsterdam, sector competitor Just Eat Takeaway lost nearly half a percent.

Euro Stoxx 50 4174.08 (+0.2%)

STOXX Europe 600470,33 (+0.7%)

DAX 15.524.27 (+0.4%)

CAC 40 7023.80 (+0.6%)

FTSE 100 7554.31 (+1.1%)

SMI 12176.90 (+0.7%)

AEX 753.79 (+0.2%)

BEL 20 4,105.45 (+0.6%)

FTSE MIB Index 26,882.47 (+1.0%)

IBEX 35 8.706.00 (+1%)

US property rights

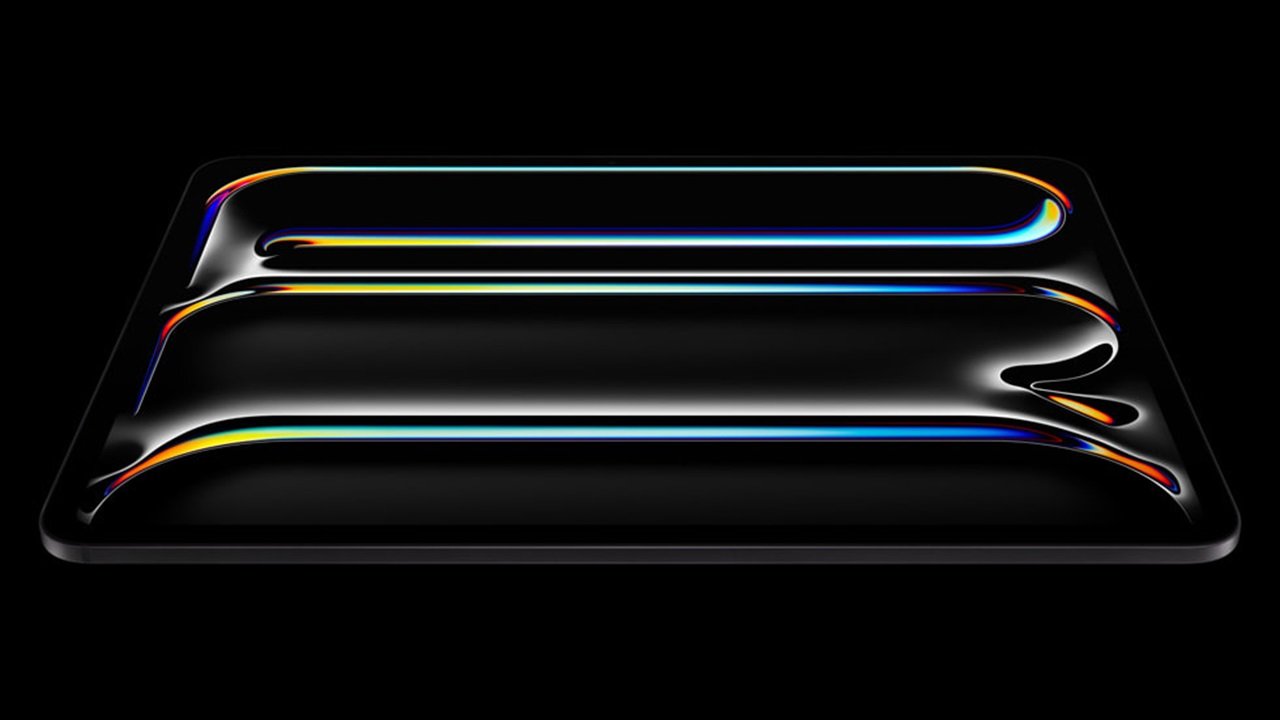

US futures are anticipating a higher open on Friday. Investors can start with better-than-expected quarterly results from Apple. Shares rose 3.5 percent in after-hours trading on Thursday after the tech giant beat expectations on all fronts.

Wall Street closed lower on Thursday. Mostly strong economic data provided the momentum initially, but optimism faded during the session.

The US economy grew 6.9 percent in the fourth quarter. This was much better than expectations of 5.5 per cent and a significant rebound from the previous quarter’s 2.3 per cent. For the whole of 2021, growth in the United States was 5.7 percent. Consumer spending, a key driver of growth, rose 3.3 percent in the fourth quarter.

According to market analyst Michael Hewson of CMC Markets, it appears that the US economy was able to recover well at the end of 2021.

The number of new requests for assistance last week was lower than expected. The number fell from 290,000 to 260,000 instead of the expected 265,000. Demand for durable goods declined slightly in December. Incoming home sales fell in the same month.

However, feelings are still fragile. The Federal Reserve indicated in its interest rate decision on Wednesday evening that raising interest rates will begin in March in order to curb inflation. According to Chairman Jerome Powell, the central bank could start raising interest rates faster than it has in the past ten years. This shows the Fed is “in a hurry,” said John Phil of Nikko Asset Management in Tokyo. “The Fed is getting serious very quickly and that is having an impact on the markets.”

The US 10-year yield rose to 1.87% after Wednesday’s interest rate decision, but traded at 1.81% on Thursday.

Analysts said the uncertainty surrounding a possible Russian invasion of Ukraine is also casting a shadow. Russia is a major exporter of oil and natural gas, and energy prices continue to rise while stock prices are falling. Phil thinks the Fed won’t rest easy on inflation until oil prices drop again.

Oil prices lost some of their gains on Thursday after a volatile session. At a settlement of $86.61, a barrel of West Texas Intermediate is about 0.9 percent cheaper.

company news

McDonald’s was disappointed with a 13 percent increase in sales in the fourth quarter. Earnings of $2.23 per share was slightly lower than analysts’ expectations of $2.34. The stock fell half a percent.

Sherwin-Williams reported a sharply lower result in the fourth quarter. This was no surprise. The stock lost more than 3 percent.

Comcast posted a 10 percent lower net profit in the fourth quarter. The stock lost nearly one percent.

Tesla made record profits last quarter. CEO Elon Musk said that no new models will be introduced this year. The stock fell about 11.5%.

Intel saw lower profits in the fourth quarter and a lower-than-expected performance as well. The stock lost 7 percent.

Netflix rose 7.5 percent after it became known that Bill Ackman’s Pershing Square Capital Management had bought more than 3 million shares in the streaming service. That would likely cost Akman more than a billion dollars.

Pfizer won 1.5 percent after Paxlovid’s corona pill received positive reviews in the European Union.

Apple generated higher-than-expected revenue this quarter, while iPhone sales also exceeded market expectations. Shares jumped more than 5% after trading closed.

S&P 500 Index 4,326.51 (-0.5%)

Dow Jones 34.160.78 (-0.02%)

Nasdaq Composite 13,352.78 (-1.4%)

Asia

Asian stocks rose mostly on Friday.

Nikkei 225 26,742,31 (+2,2%)

Shanghai Composite 3.406.63 (+0.4%)

Hang Seng 23,621.62 (-0.8%)

Lives

The EUR/USD is trading at 1.1154 this morning. At the close of US markets on Thursday, the currency pair moved at 1.1146.

USD/JPY Yen 115.41

EUR / USD EUR 1,1154

128.73 Euro / Japanese Yen

Macro schedule:

06:30 Producers Awards – December (NL)

06:30 Product Confidence – January (NL)

07:30 Economic Growth – Fourth Quarter vpg. (French)

10:00 Money Show – December (Euro)

11:00 Consumer Confidence – January Defeat (EUR)

11:00 Economic Growth – Fourth Quarter vpg. (communicate)

11:30 Inflation – Jan (Bill)

14:30 Personal Income and Expenditure – December (US)

14:30 Labor Costs – Q4 (US)

16:00 Michigan Consumer Confidence – January defeat. (we)

Company news:

07:00 UniCredit – Fourth Quarter Numbers (ETA)

13:00 Caterpillar – US Fourth Quarter Numbers

13:00 Colgate Palmolive – American Characters in the Fourth Quarter

13:00 Chevron – US Fourth Quarter Numbers

Pron: ABM Financial News

From Beursplein 5, Editors ABM Financial News Keep a close eye on developments on the stock exchanges, and the Amsterdam Stock Exchange in particular. The information in this column is not intended as professional investment advice or as a recommendation to make certain investments.

“Total coffee specialist. Hardcore reader. Incurable music scholar. Web guru. Freelance troublemaker. Problem solver. Travel trailblazer.”

More Stories

Helpful change at checkout: “Easier and saves you time at checkout”

The Attorney General warns: “Frauds are increasing in these repair services.”

The best cheese in Spain comes from the Canary Island of Lanzarote